Managing Expenses in a Six Sigma Way

Many of us have experienced the pinch of money from time to time. We earn a greater income, yet our expenses seem to be proportionally scaling to the same heights, regardless of inflation, cost of living and other exceptions. It’s not just being frugal that can minimize our expenses – money management is just as, if not more important. So why can’t Six Sigma be utilized in this situation as it is has been widely accepted and implemented across many Industries for quite some time now? This is how I began my Six Sigma project, “Managing Expenses in 6 Sigma Way”. This project is based on my own experience; all the data, inputs and outputs are related to my life.

The DEFINE phase began by creating the SIPOC (Supplier, Input, Process, Output and Customers) and a high-level process map. The process map showcases how the income was received and how it was spent and if there was shortage of income when credit cards and loans were taken. Next, the CTQ (Critical to Quality) tree was created – it categorized the expenses into fixed expenses and variable expenses. Under fixed expenses, rent and EMI’s (equated monthly installments) were put across and under the appropriate variable expenses such as: water, electricity, cell phone, travel and vehicle maintenance. A project milestone of four months was planned and a project charter was prepared. A problem statement shows a high proportion of spending compared to the income received. Project in-scope was the monthly salary, loans and credit cards while project out-of-scope was perks, investment returns, compensation and lottery. A goal statement was to reduce personal expenses by 50% and the CTQ was to reduce expenses. The financial estimate was to save a few thousand Indian rupees every month. The timelines were allocated for each phase. For the Define and Measure phase, one month was allocated; for the Analyze phase two months, for Improve phase two months and for Control phase one month. This marked the completion of the Define phase.

In MEASURE phase, it started with a data collection plan for all the expenses incurred, incomes received, and credit card/loans received. The Pareto chart was created and the list consisted of rent, credit card dues, personal loan EMI, vehicle loan EMI, food, travelling to/from home, cell phone, vehicle maintenance and miscellaneous expenses. Out of these listed expenses, only seven causes were considered as per the 80-20 Pareto rule. These seven expenses were categorized into controllable and uncontrollable expenses. Personal loan and vehicle loan were put under uncontrollable expenses as these were paid according to equated monthly installment. Controllable factors were credit card dues, rent, food, travel and cell phone. All these were taken for further study and an I-chart was prepared from these controllable expenses, which highlighted the mean at 10.858 thousand rupees per month expenditure.

In ANALYZE phase, credit card dues were further drilled down by using the Pareto chart – interest charges, EMI and late fee charges were taken into consideration. The fish-bone (cause & effect) diagram was created for the credit card usage. Out of all the causes listed, only two causes were considered after making use of the Control Impact matrix. Vital cause number one was, ‘blindly believing the credit card statement generation’, and second one was, ‘buying of unwanted stuffs frequently’. The analysis for the first cause was the rate of interest and charges that were exorbitant – a few unknown charges were also listed in the statement and were ignored frequently. The analysis for the second cause was that unwanted dress materials were bought from garment companies because of sale advertisements such as: buy 2 get 3 free, stock clearance sale, 50% off, etc.

A rent analysis was done using a Contour Plot chart and considered three vital factors: the location, rent cost and necessary commutes. It was determined that the farther the location, the more time was lost (depicted in the graph above using the location range.) The closer the location, which is considered near the city in an 8 to 15 kilometers range, the more expensive rent became – nearing anywhere from 2,000 INR to 3,000 INR.

The FMEA (Failure Mode & Effect Analysis) tool was utilized for rent analysis. It showed that there was a high influence from peers in selecting the present housing location, which resulted in a location much nearer the city.

The food analysis was done using a fish-bone diagram and showed that office cafeteria food, junk food and weekly parties were the major contributors of concern for paying heavily. For those top 3 contributors, a 5-Y analysis was done and determined that cafeteria food was more expensive compared to the prevailing market price. Unhealthy junk food was often consumed due to mismanagement of time which resulted in higher spending on medicines and gym memberships. Weekly parties were a major setback as one needs to travel to the city center, passing through heavy traffic, to go to a venue/restaurant where items are overpriced. In addition, there were parking charges that were steep during weekends.

Travelling was the next reason for heavy spending. From the Pareto analysis, the focus was on the following top 3 contributors: airfare, taxis/rentals and non-budgeted shopping. The major reasons for the above listed categories was the non-scheduled booking of airfare or other transportation – last moment booking is always more expensive. Non-budgeted or unplanned shopping resulted in buying unnecessary gifts and paying higher costs due to the shortage of time to search for competitive pricing.

A cell phone analysis was done using an Interrelationship diagraph. It highlighted office calls and friend/family calls as the critical cause of the frequent calls. Most of the calls were to office landlines and to friend/family cell phones which were not local numbers. Therefore, the selected phone plan was not efficient as it was only suited for calling local cell phones and did not even include landlines.

In IMPROVE phase, an improvement plan and an actionable plan were created. Credit card usage and clearing off interest dues was considered a priority. An economical personal loan was considered best as it would reduce the burden of paying high interest rates.

The next actionable was to cut down on high rent. The root cause analysis determined that higher rent was being paid simply for living in the city, which also resulted in time loss commuting to the office. So housing closer to the office rather than the city was planned.

Bringing meals to the office rather than consuming office cafeteria food was decided which also set the pace for not skipping lunch for snacks and junk food. Weekly parties were now planned to be held at friend’s houses instead of restaurants or venues in the center of the city.

Now commuting was scheduled well in advance by keeping reminders and alerts in cell phones and calendars. Tickets and gifts were also able to be purchased at ease and at an economical price.

The cell phone plan was changed to an appropriate plan with economical calling rates to landlines and to local, as well as non-local cell phones.

All the improvement actions were planned to be implemented within a month at which time data was collected for the next 3 months.

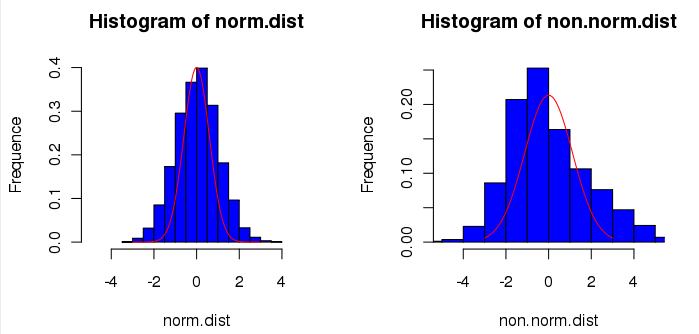

In CONTROL phase, the comparison was made between the 6 months data of the pre-expenses and 3 months data of the post-expenses. Post the implementation, the mean was shifted from 10.3 thousand to 4.4 thousand per month. The goal statement of 50% reduction in expenses was successfully realized and has been sustained from then on. Core controls were built across using the FMEA tool on each of the solutions listed to sustain the consistency over a period of time.

Raman Pushkar is a consultant with Anexas Six Sigma Consultancy in Bangalore, India. He earned his Black belt from Anexas Consultancy Se, Green Belt from Deutsche Bank Group and became an ISO 27001 Certified Auditor from Ness Technologies. Earlier to this assignment he worked as a Process Supervisor in Deutsche Bank Group in Bangalore, India and as a Senior Quality Analyst in Ness Technologies in Hyderabad, India.

Contact him at ramanpushkar@gmail.com