The Efficient Experience

Eliminate the Unessential, Streamline the Essential, & Invest in the Valued.

An efficient experience is a win-win-win. It is a win for the customers when an efficient experience delights them. It is a win for the front-line employees, who are supported by competent processes and systems, and engage in more positive encounters with happy customers. And it is a win for the company to save money, while at the same time reaping the revenue benefits of more customer retention, referrals, and wallet share.

Pursuing an ‘efficient experience’ is compelling, tangible and measurable. It has the clarity to motivate the organization to determine where and how to eliminate the unessential, streamline the essential, and invest in the valued – creating ‘efficient experiences’ for all involved.

An efficient experience is a good experience for everyone involved. An inefficient experience is a bad experience for everyone involved. It’s that simple.

Picture these scenes from a cable company:

• The tech who says to the customer, “If they [the Call Center Rep.] told me you had this problem, I wouldn’t have to come back later with the signal amplifier.”

• The customer that calls with a billing dispute, because their expectations were not managed.

• The customer that said to the tech, “While you’re here, put in a DVR box,” and the reply was, “You’ll have to call Sales to order and schedule that separately.”

The common theme is: wasted time for both customers and employees. In all these cases, an inefficient encounter amounted to a bad experience for both.

Conversely, an efficient encounter is a good experience for both the customer and the employee … and ultimately good for the company and its bottom line (more revenue and less cost). Yet effectively designing and delivering an integrated experience between the company and its customers is lacking. Too often, in the zeal to achieve ‘operations excellence,’ the customer experience is sacrificed. Likewise the ‘customer experience’ zealots are inclined to spend-what-it-takes to create a desired, sometimes somewhat intangible, experience. A focus on the ‘efficient experience’ enables a company to demonstrate competence and fulfil the promise to appropriately care for each of its customers on each interaction.”

So how do you define an efficient experience?

So how do you define an efficient experience?

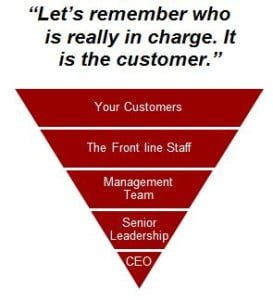

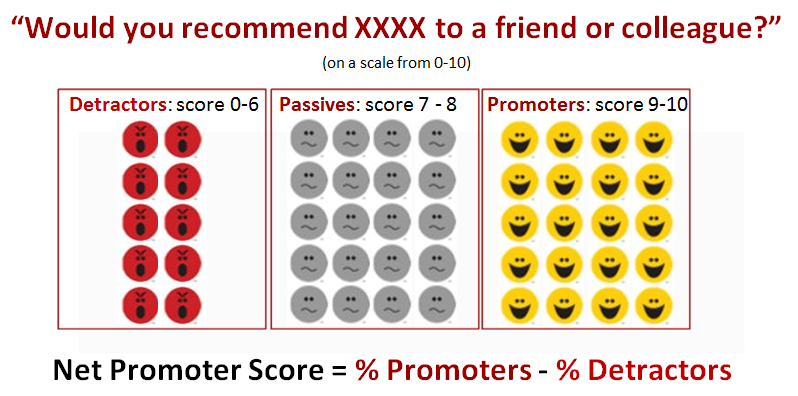

Let’s remember who is really in charge. It is the customer. An efficient experience is in the eyes of the beholder … first and foremost – the customer – they are the ones paying for it. The highly regarded Net Promoter ScoreTM (a customer loyalty metric developed by Fred Reichheld, Bain & Company, and Satmetrix) provides a way to think about it. There are detractors, passives, and promoters of your company, and it comes out when asked “Would you recommend XXXX to a friend or colleague?”

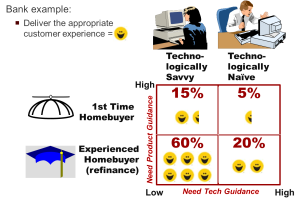

However, when customers say they would strongly recommend (promote) a company to a friend or colleague, it is always done within their individual context. And, unfortunately one experience does not fit all. Think of the first time home buyer applying for a mortgage. They would like a lot of hand-holding through the process – for them this is a desired, and efficient, experience. On the other hand, an experienced frequent home buyer would be annoyed by such handholding. The same goes for the degree to which a customer is ‘tech-savvy,’ where a savvy customer will not value extra handholding with an on-line application, and the tech-naïve customer will value help without going on-line.

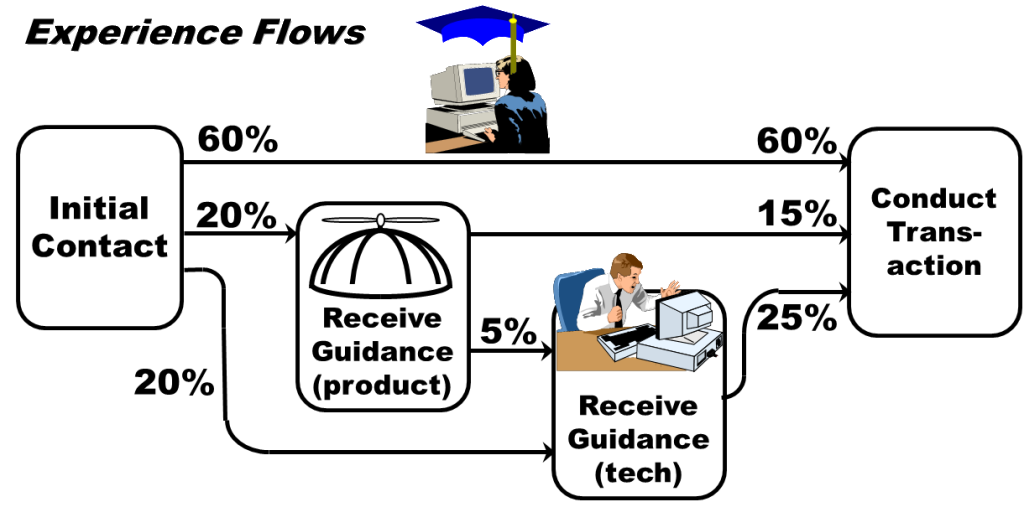

So if we think about the bank example, it could be that four different processes are required to deliver four different experiences.

In this example, 15% of the ‘promoters’ laud the bank for its ability to efficiently handle the tech-savvy first-time homebuyer (with a high need for guidance about the mortgage process). Yet 20% of the promoters give high scores for exactly the opposite – the ability to handle the experienced, but technologically challenged, homebuyer. Understanding the rationales behind the rankings is critical.

Once you have a definition of the desired efficient experiences, it becomes possible to assess and redesign processes to deliver them. With a clear definition of customer segments based on service needs, it is possible to assess the activities in an experience to determine where and how to eliminate the unessential, streamline the essential, and invest in the valued.

So how do you assess today’s experiences?

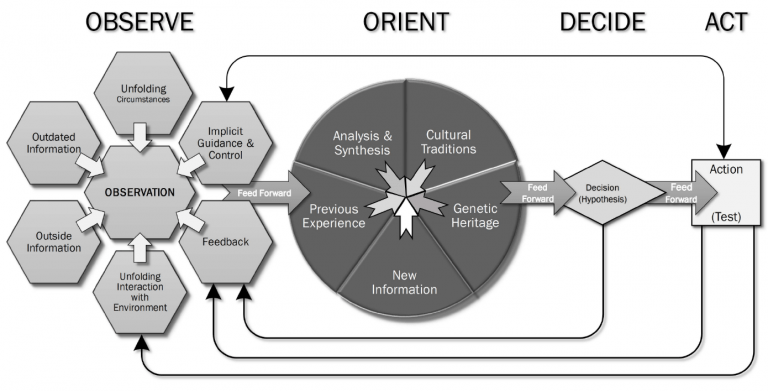

Define all the activities, or steps, involved in the experience from both the customer and employee perspectives.

First let’s look at defining the steps. Typically a Business Process Map with 50 – 200 steps provides the detail needed to uncover the key opportunities to improve the experience.

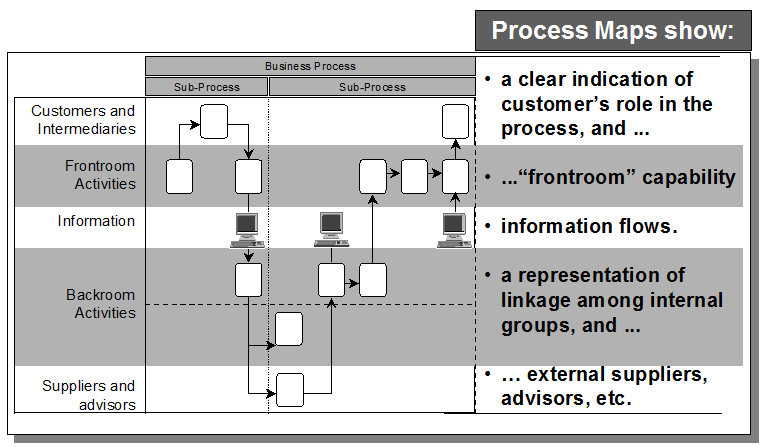

A business process map depicts the activities and sequence required to deliver value to the customer. As illustrated below, process maps are read from left to right. In a sense, these maps are like a road map in that they display a variety of possible paths in the sequence of work tasks. While we emphasize the major highways, the less traveled offshoots and back roads are also displayed.

A business process map depicts the activities and sequence required to deliver value to the customer. As illustrated below, process maps are read from left to right. In a sense, these maps are like a road map in that they display a variety of possible paths in the sequence of work tasks. While we emphasize the major highways, the less traveled offshoots and back roads are also displayed.

These maps present a bird’s eye perspective of the normal progression of work. Perhaps most important, we depict activities performed by or with the customer on the top horizontal band.

The map provides a foundation on which to build a quantitative model of the process. When actual process and cycle times are added to a map, new questions are often raised when it comes to the experiences of customers and employees. For instance, the process of obtaining a mortgage is a good example. There are roughly a few hours of employee effort to process a mortgage, yet the process takes weeks (if not months) from the customer’s perspective … and waiting is not an efficient or desirable experience.

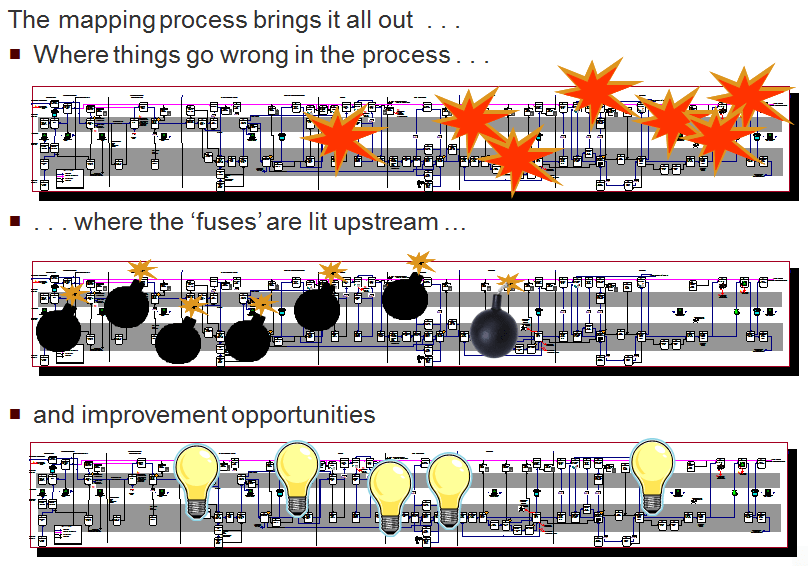

With a map of the current process, an evaluation of the process and steps can be made in the context of the customers’ definitions of a desired efficient experience. So, in the banking example, for each type of customer, it becomes possible to determine where and how to eliminate the unessential, streamline the essential, and invest in the valued.

So for the savvy customer, too much handholding is where things blow up. And the fuse is lit back in the beginning of the process when they are sent down the same experience journey as the naïve customer.

The map provides the means to assess the experience for each customer type, and in that context define: where things blow up, where the fuses are lit, and ideas for enhancing/creating the desired experience.

So how do you create efficient experiences? . . .

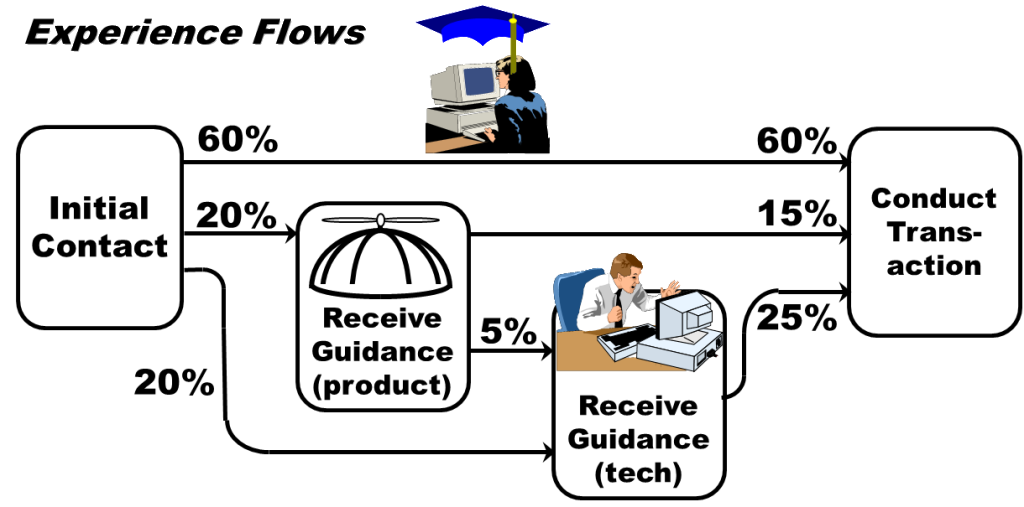

With the flaws and opportunities identified for each type of customer, it becomes possible to put them on the right path. At its simplest (using our banking example), those who want more contact get it, those who don’t will bypass the steps that are unessential to them. Distinct processes, or ‘experience flows,’ can be established for each type of customer.

The point is to define desired ‘results’ and the preferred ‘efficient experiences’ as defined the various customer types want to be handled.

In the big scheme of the things there are two roads to results – people and tools – and they have to merge. Whether it is a farmer on a tractor, or a person at a desk with a computer and a phone, it is the merging of what tools do and what people do that becomes ‘work.’

How work is done drives results. Let’s look at two examples of creating an efficient experience, one more people driven and the other more tools &technology driven.

. . . change what people do (customers and employees)

A number of years ago, as described in my book Quick Hits,1 Weight Watchers did exactly that – improved the customer experience and made the staff more productive within the meeting room environment. The directive was clear – not only with its insistence on not sacrificing the customer experience for the sake of saving money, but especially on its insistence that the customer experience comes first. As the Weight Watchers’ project manager, Judy Donnenfeld, pointed out, “Our service is emotionally charged, with a high degree of empathy and interaction among members and service providers. Retention of existing customers, referrals of new customers, and ultimately their revenue is highly dependent upon a great one-hour experience each week.” The challenge was to make the meeting experience better for both the employees and customers … and to save money.

We observed a 3-step process. A member would wait in line to approach a Filer who would retrieve the member’s card from a card file. Then the member would (sometimes wait again to) pay the Cashier for the meeting. Then step three, the value-added step was weigh-in, performed by a Weigher.

We also established the processing times for the ‘get card,’ pay, and weigh-in steps. Here we found the need to distinguish new enrollees (naïve) from current members (savvy). The time to enroll a new member was longer than the time to check-in a current member. We also noticed that the current members waited over 33% as long on average as new enrollees. Here was a classic case of slow-to-process work, holding up the fast-to-process work.

With facts in hand, a model was built to rapidly simulate many more meetings than we could possibly view in person. Plus a computer-based dynamic simulation model could provide detailed information on the length of the lines and waiting times for both reception desks (“get card’ and ‘pay’) and weigh-in.

We found a few very simple changes could have a huge impact.

The first was to have the customer do some of the work. In this case the members could retrieve their own card. There was no need to have a dedicated receptionist pulling each member’s card and handing it off to the member. We found that the act of finding and pulling the card was twice as fast as making the payment. So, the ‘card puller’ was already inactive ½ the time, and the time they were active did not add any value. We also found that the members were twice as fast as the ‘card puller’ in finding their card anyway (probably because a member knows their name, how to spell it, and where to find it quickly in an alphabetical listing). So we suggested that the box of cards be placed out in front of the desk, so the member could retrieve their own card while in line … if there was a line. This combination self-service process would free-up one service provider to either assist with collecting the payments or assist with weigh-in, … or not come in at all.

But we had to make some other changes as well. A two-step process (pay and then weigh) was still undesirable. We looked at combining the steps into one stop.

The one-stop ‘pay & weigh’ enabled the wait times can be dramatically reduced. There was 87% less wait time on average for current members and 66% less wait time for new enrollees. So while the one-step process has the longest processing times (with the combined steps), the one-step process has the shortest wait times. There is no idle time on the part of the service providers at the ‘pay & weigh’ stations until all the members have all been processed.

Hence the new process enabled significantly better service for the customer (less waiting in line, more attention at weigh-in, meetings start on time w/less interruptions). The new process also enabled the employees to focus more time on value-added work (weigh-in and counseling with customers), and less on administrative tasks. Plus, Weight Watchers was able to provide an efficient experience for more members per meeting with same staff – therefore keep its prices low to attract and retain more members.

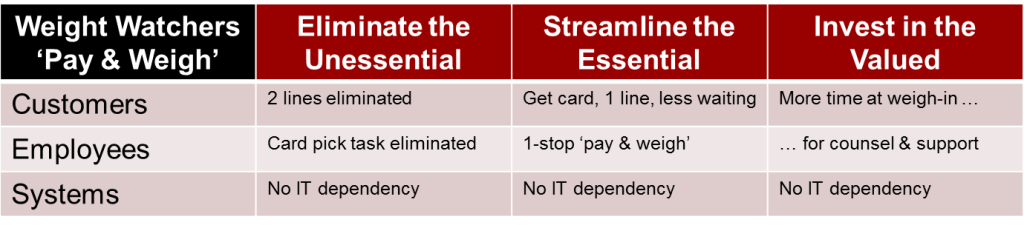

In order to achieve an efficient experience for all involved, Weight Watchers eliminated the unessential, streamlined the essential, and invested in the valued activities:

Perhaps the most striking aspect of the Weight Watchers project, was the lack of any dependence on information technology (IT) to create a new ‘efficient experience.’ While redesigning a new experience without technology is great (less cost, less time, etc.), most experience redesigns will likely have some, if not extensive, dependence on technology.

. . . use tools & technologies

As the cost of technology continues to decline, and the public’s eagerness to adopt new technologies increases, the technology-based ‘efficient experience’ is more the norm. One of the biggest game-changers is, and will continue to be for some time, the internet along with the smart phone. There is the capability to take the experience of customer care from miserably inefficient (for customers and employees) to manageable, efficient, and perhaps even desirable.

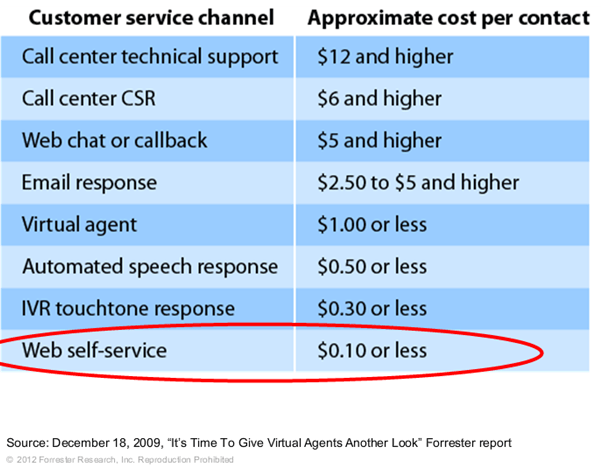

It is easy to understand how self-service (IVR, smart phone, or web-based) is desirable for the company … it costs a lot less (see Forrester Research profile of cost per contact type). But how is it better for the customer? It’s better because it can enable an efficient experience for them too. With the increase in mobile usage, the customer can utilize their preferred method of communication with companies (app, web, voice, social media, etc.), thus making the customer more comfortable to with the interaction.

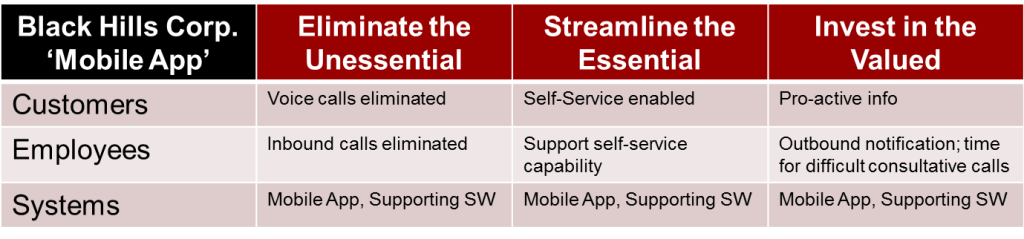

Let’s look at the recent implementation of smart-phone customer care at Black Hills Corp., as described in a recent press release.2 Black Hills is a gas and electric utility company based in Rapid City, SD. The company’s 2,000 employees serve 765,000 customers in Colorado, Iowa, Kansas, Montana, Nebraska, South Dakota and Wyoming. With a tradition of exemplary service and a vision to be the energy partner of choice, they choose to lead the industry in finding better ways to serve their customers.

Using a mobile app, and related software, from Zappix, customers are able to obtain a mix of self-service care and, when desired, a quick push-button connection to appropriate call center reps without the tedious menus (“press 1” for this, and “2” for that, …). This eliminates the frustration and errors that can happen with voice menus … errors that annoy the customer, as well as the call center reps when they have to reroute the call.

More importantly the smartphone experience can eliminate calls and/or an exasperating experience with an IVR. For example, imagine the frustration when listening to instructions and trying to read the electric meter at the same time. Hearing instructions and then submitting the meter reading takes more than 1 min on the IVR (and even more on a live call). The same task only takes 20 sec on smartphone because the instructions appear as pop-up text on the app and the reading can be submitted via smart menus.

The app also provides push-buttons to link customers directly to their accounts. The Zappix app provides a secure option that allows customers to store and retrieve their account number so they don’t have to remember it each time they call. Customers get one-click access to make payments, get outage information and other self-service options available to them on their utility’s website.

Another feature of the app is “push” notification. So in the event of an outage the customer can be sent a text or call about the outage and progress toward restoring power. Such proactive communication can prevent numerous calls from coming into the call canter.

All of these features provide a much more efficient experience for the customer, and for the company. Let’s assume each of their 765,000 customers calls once per year (for example only, we have no basis for this assumption). Assume, after some adoption of the technology, 200,000 calls are eliminated through self-service and pro-active prevention of calls. A $6 per call transaction is replaced by $0.10 per self-service transaction. The savings would amount to $1,180,000 per year, and double that as the adoption rate rises to 50%. (In reality it is not quite that simple. In all likelihood, the simple calls would be replaced by self-service, leaving the call center with the fewer but time-consuming difficult calls. Still, you can see the potential gains.) So just like Weight Watchers, Black Hills eliminated the unessential, streamlined the essential, and invested in the valued activities to achieve a more efficient experience for all involved:

The Efficient Experience – a Win-Win-Win

So, while the financial benefits may be great for the company, the more important point is that it does not cost more to provide an efficient service experience for the customer. Plus pursuing an ‘efficient experience’ is compelling, tangible and measurable. It has the clarity to motivate the organization and engage multiple functions in its pursuit. The experts from all camps (“Customer Experience,” “Six-Sigma,” “Operations Excellence,” etc.) can get engaged to determine where and how to eliminate the unessential, streamline the essential, and invest in the valued – creating ‘efficient experiences’ for all involved.

An efficient experience is a win-win-win. It is a win for the company to save money, while at the same time reaping the revenue benefits of more customer retention, referrals, and wallet share. It is a win for the customers when an efficient experience delights them, and leads them to become ‘promoters.’ And it is a win for the front-line employees, who are supported by competent processes and systems, and engage in more positive encounters with happy customers.

© 2014

Kelvin Cross, President – A business process innovation leader, consultant, lecturer, and author. His most recent book is Quick Hits.

Russell Onofrio, Partner – An expert in contact center management, process improvement, customer experience, performance management and technology.

Cross-Rhodes is a 20 year-old firm of senior business operations consultants. Specifically, we investigate & resolve work process problems, design new ways for work to get done, assess the staffing and cost impact of changing systems & work flows, and at the same time transfer our skills to your people. We bring expertise without the attitude.

CONTACT: kelvin@cross-rhodes.com, 617-275-3007; or russ@cross-rhodes.com, 508-341-6621